The market for private health insurance

The market for private health insurance

Only very few countries in the world rely on a privately organised market for health insurance. Besides the United States and Chile, Germany is one of the very few countries with an entirely private health insurance market, not just a supplemental one. In Germany the statutory health insurance insures about 90% of the population while the remaining 10% are covered by the market for private health insurance. Since the market for health insurance experiences regular adjustments initiated by law this offers great opportunities for economic analysis and evaluation.

Research:

One of those above mentioned legal changes in Germany’s market for private health insurance affects the front-loading of premiums and in particular the obligation of insurers to accumulate old-age provisions for each enrollee. Effective 2009, the German legislature passed a bill that mandated old-age provisions to be made portable to a standardised extent. Until 2009 those old-age provisions were not transferable to competing insurers. The intention of the bill was to reduce switching costs and foster market competition. In Atal et al. (2017) we study theoretically and empirically how consumers respond to this newly mandated portability requirement of their old-age provisions.

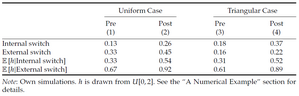

Our theoretical model predicts that the portability reform will increase internal plan switching. However, under plausible assumptions, it will not increase external insurer switching despite reducing switching costs. Moreover, the portability reform will enable unhealthier enrollees to re-optimise their plans. Table 1 shows the simulated effect of portability reforms on internal and external switching.

Table1:Simulated Effect of Portability Reform on Internal and External Switching (Atal et al., 2017).

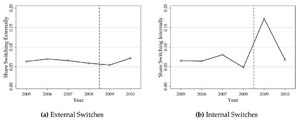

The empirical investigation is based on detailed claims panel data from one of the largest German individual private health insurers. In total, we observe more than 300,000 policyholders from 2005 to 2011. The predictions of the theoretical model are empirically confirmed in our data. Figure 1 descriptively shows how internal and external switching rates changed over time.

Figure 1: Share of Enrollees who Switched by Year (Atal et al., 2017).

Cooperations:

This project is carried out together with Juan Pablo Atal and Hanming Fang from the University of Pennsylvania and Nicolas Ziebarth from Cornell University.

Publications and working papers:

Atal, Juan Pablo & Fang, Hanming & Karlsson, Martin & Ziebarth, Nicolas, 2017. Exit, Voice or Loyalty? An Investigation into Mandated Portability of Front-Loaded Private Health Plans. Forthcoming in The Journal of Risk and Insurance. Link

Spreeuw, Jaap & Karlsson, Martin, 2009. Time Deductibles as Screening Devices: Competitive Markets. Journal of Risk and Insurance, Vol. 76, Issue 2, pp. 261-278, June 2009. Available at SSRN: Link

Karlsson, Martin & Klohn, Florian & Rickayzen, Ben, 2012. Are the dimensions of private information more multiple than expected? Information asymmetries in the market of supplementary private health insurance in England. Darmstadt Discussion Papers in Economics 213, Darmstadt University of Technology, Department of Law and Economics. Link